Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

Why Are Interest Rates Rising…and What Does It Mean for the Stock Market?

SUMMARY

- Long-term interest rates have been rising.

- We believe this rise is primarily related to improved growth prospects.

- Thus, we still prefer stocks over bonds.

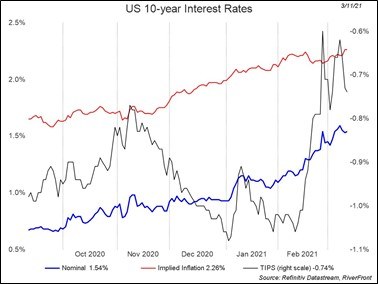

After a prolonged period of hovering near all-time lows, the US 10-year Treasury yield has been on the move lately (see chart). This is not wholly unexpected, nor it is necessarily something for the stock market to be concerned about, in our view. In RiverFront’s 2021 Outlook, both our base case and bull case scenarios for stocks predicted rates rising this year; at the upper end, we predicted a range as high as ~1.80% on the US 10-year Treasury.

However, the speed with which rates have risen recently– from a low of just over 1% at the end of January to currently over 1.6% - has some market participants spooked, contributing to recent stock and bond market volatility.

The reason for the market’s concern is that quick, significant rate increases can suggest that inflation expectations are rapidly rising. The specter of inflation tends to have an adverse effect on stock market valuations, as inflation concerns generally cause the Federal Reserve to tighten financial conditions and raise their target rates, slowing economic growth.

Federal Reserve Not Likely to Raise Target Rates Anytime Soon, In Our Opinion

Should the stock market be concerned today about the Federal Reserve tightening conditions? We do not believe so. In previous Weekly Views, we have put forth why we believe that high inflation is likely to be transient in 2021. Importantly, we believe rates are rising right now mainly because economic growth potential is improving – a positive for stocks - not because of a dangerous increase in the inflation impulse. The consensus forecast for US and global GDP growth for 2021 has been revised higher in the last several months, a function of higher stimulus and a rebound in economies affected by the pandemic shutdown in 2020. Despite these higher GDP forecasts, we are not observing a large propensity to raise wages among employers or significant increases in pricing power at US retailers in the various survey data we track – suggesting core inflation remains in check.

We would argue the bond market agrees with our sanguine view on inflation, despite the recent uptick in yields. One way to we try to interpret inflation expectations is to compare the yields on Treasury Inflation-Protected Securities (TIPS) to the yields on regular treasuries of the same tenor. Because TIPS principal payments are adjusted to reflect the change in inflation as calculated by the Consumer Price Index (CPI), the difference in yields between the two bonds theoretically should equal the market’s inflation expectations over that time horizon. The TIPS analysis suggests to us that the recent rise in rates is imputing a level of inflation approximately equal to 2.3% over the next seven to ten years (see red line in right chart). This is close to the Fed’s official goal and hardly a 1970s scenario, when inflation averaged over 7% annually across the decade. These inflation expectations are low enough, in our opinion to keep the Fed on the sidelines for quite some time with regard to target rate hikes.

We also believe that the Fed not likely to start verbally talking up expectations for rate hikes in the near-term, because the jobs market in the US is still highly dislocated in industries such as entertainment and hospitality. In a meeting with Congress towards the end of February, Fed Chairman Jay Powell suggested that the Fed has no intention of raising target interest rates until it thinks its dual mandate of maximum employment and inflation containment have been reached. He noted in the same meeting that he believes the actual unemployment rate in the US is closer to 10% than the official 6.2% statistic, due to workers giving up and dropping out of the job-seeking population altogether. In a more recent interview last week with the Wall Street Journal, Powell said the Fed sees the current inflationary impulse as only ‘transient’ versus persistent. With the two-day Federal Open Market Committee (FOMC) policy meeting starting Tuesday March 16th, we will get another update into Fed thinking with regards to inflation.

Treasuries’ Recent Rise May Be Capped in Near-Term

In addition, note that foreign investors may be increasingly interested in buying treasuries, providing large demand and thus a potential ceiling for US yields in the near-term. Even after adjusting for the cost of currency hedging, US treasuries now have higher yields than European or Japanese bonds, according to a recent Wall Street Journal article. This is a departure from much for 2020, when foreign bonds offered superior yields to US ones when factoring in hedging costs.

Conclusion: Stocks Should Not Yet Fear Rising Rates

Because we see the move up in interest rates as primarily driven by better economic growth prospects rather than fears of sustained inflation, we remain positive on stocks. Across our balanced asset allocation portfolios, we continue to be positioned overweight stocks relative to bonds versus our baseline benchmarks. We will continue to monitor rates and the message of markets closely and will adjust our portfolios accordingly should our view of potential inflation meaningfully change.