Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

Valuations Could Stay Elevated… and that is OK in our view!

SUMMARY

- So far, S&P 500 earnings are coming in significantly better than was expected as the pandemic unfolded.

- With interest rates and inflation likely to remain subdued, we do not see valuations as excessive.

- As a result, we remain overweight stocks in RiverFront’s global balanced portfolios.

Last year during first quarter 2020 earnings season - the first period impacted by the novel coronavirus - we advised investors to pay attention to the words and tone used by management teams discussing current business conditions. Words mattered more than the numbers as Wall Street analysts were forced to reduce forecasts significantly for 2020. Now, we know the lowered estimates were too conservative. As the recovery unfolds, it appears the S&P 500 is on the verge of returning to positive growth for the first time since the end of 2019. We now believe the words and the numbers matter.

This week’s focus on earnings is about more than just earnings season. Concerns over market valuation are growing louder. Corporate earnings garner attention as one of several financial components of a company’s performance. Ratio-based analysis, a common approach used to assign values to companies, helps us determine relative valuation. The S&P 500 is currently valued at a P/E multiple of 22.2x forward 12-month earnings. This is above the five- year average of 17.7x according to FactSet and is one of the reasons some investors are worried. An absolute number, such as 19x for example, carries little meaning by itself because there is no context. It becomes more useful when measured against the company’s historical price-to-earnings (P/E) range, that of the competition, and the ratio for the market as a whole. We believe other important factors include the economic backdrop and interest rate environment. We need to be aware of above average valuations, but the fact that equity markets are considered ‘expensive’ is not reason enough to cause markets to trade lower.

We believe there are several factors that could support above average valuations.

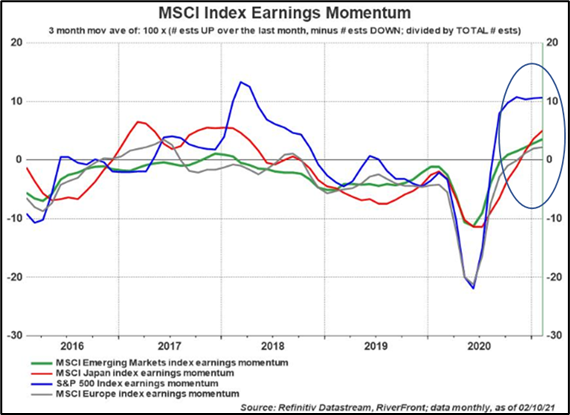

Earnings revisions are trending higher:

The circle in the chart right illustrates the strength in global ‘earnings momentum’ – a ratio of how many analysts’ estimates for quarterly earnings are being revised higher versus lower. A reading above zero suggests positive net revisions – a sign analysts were too pessimistic. For the US, S&P operating earnings were forecast for 2021 to be $164.40 at the beginning of the year and now are $170.55. If achieved this would be an all-time high for S&P 500 operating earnings per share. Given all the economic disruption from COVID-19, this would be remarkable and one of the reasons why the S&P 500 has done so well over the past twelve months.

While not all regions of the world will show positive year over year growth, earnings in Europe and Japan are also surprising positively. Earnings surprises generally lead to revisions. There remains a large gap between the highest and lowest consensus forecasts for forward estimates for the S&P 500. In our opinion, that disparity underscores the element of unknown that remains as we look ahead through the remainder of 2021 and try to gauge a fully reopened US.

Interest rates will likely stay low for a while:

We believe equities remain the most attractive asset class for long term investors as interest rates will likely stay low for the foreseeable future. In the January 19th Strategic View (The 21st Century Retirement Plan: Sustain Phase), we discussed the relative attractiveness of dividend yields when compared to 10-year Treasury bond yields. This relationship is shown in the chart right. During his most recent comments, Federal Reserve Chairman Jerome Powell signaled continued policy support noting the need for ‘patiently accommodative monetary policy’ as the US employment picture continues to struggle. The US unemployment rate has fallen from the 2020 high of 14.8% to 6.3%, but it is still above the Fed’s target of between 4% and 5%.

The inflation outlook remains reasonable:

At this writing, leaders in Washington D.C. are working to pass President Joe Biden’s proposed $1.9 trillion coronavirus relief bill, adding to the already record fiscal and monetary stimulus that we have seen thus far into the pandemic crisis. This has sparked fears of a return to inflation, but we believe inflationary pressures are tame for now. The most recently released core Consumer Price Index (CPI) rose 1.4% for the twelve months ending in January, which was the same increase for the prior period. In our opinion, this does not signal inflationary pressure. Another barometer used to gauge inflation is the Employment Cost Index, which measures compensation costs such as wages and benefits paid by employers. The January report showed that it is also holding steady.