Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

SUMMARY

- US still in the driver’s seat in trade negotiations, in our view.

- US stocks’ resiliency is likely related to this power dynamic, as well as strong earnings results.

- We remain constructive on US stocks but are monitoring risks closely as we head into autumn.

The day of reckoning is here. Earlier in the summer, the Trump Administration set a global trade deal negotiation deadline of August 1. This date has now come and passed without resolution for crucial US trade partners such as China and Mexico, along with more punitive terms for others like Canada. US stocks have generally been taking trade uncertainty in stride with numerous all-time highs made recently. However, volatility returned due to Friday’s weak US payroll data, causing the S&P 500 to close in the negative last week.

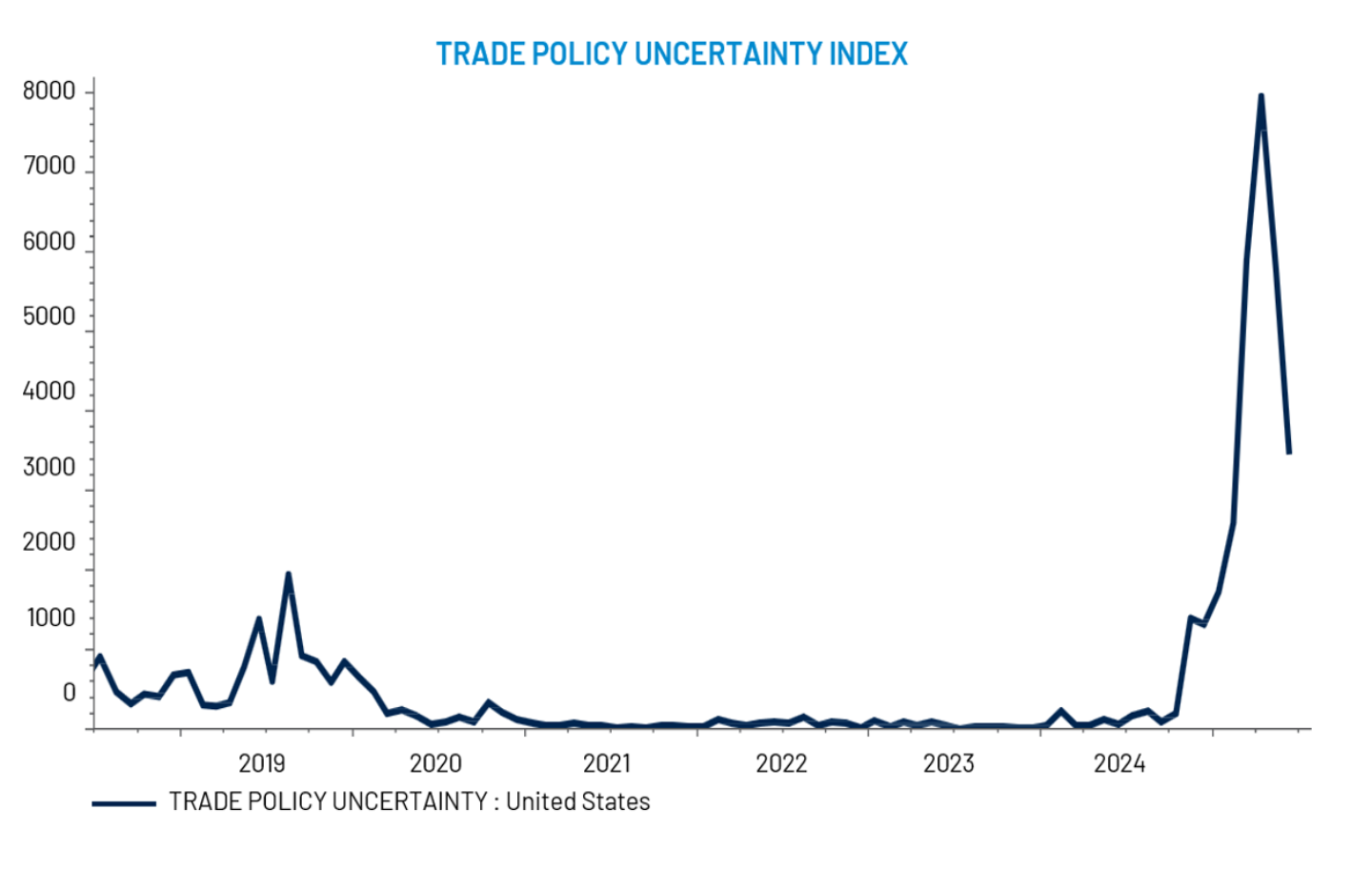

Trade uncertainty, while remaining elevated relative to history, has decreased (see Chart 1, below) as the US selectively dictates both terms and timing of trade deals. Haphazard as the process has seemed at times, we believe the US is demonstrating formidable bargaining power in trade negotiations – an indirect manifestation of the US ‘Economic Exceptionalism’ theme we have been espousing for years. In our view, the US philosophy of negotiating bilaterally with a dizzying array of ‘carrots’ and ‘sticks’ is leading to some favorable results for the US, despite bouts of volatility.

For instance, the US appears to be the clear winner in the EU trade deal that was jointly announced a week ago by President Trump and EU Commissioner Ursula Von der Leyen. Under the terms of the agreement, the US tariff of most EU goods would be locked in at 15%, with EU tariffs on US goods mostly eliminated…highlighting the disparity in power dynamics between the two blocs. This announcement follows hot on the heels of earlier agreements with Japan and South Korea which, like the EU deal, also include large purchase commitments for US energy and guarantees for foreign direct investment. Similar deals with Vietnam and Indonesia waive tariffs on US goods entirely.

Chart 1: Trade Uncertainty, While Still Elevated, Is Dropping

US Still Clearly in Driver’s Seat for Trade Negotiations

As we have learned this year, ‘resolution’ is a relative concept when dealing with current US trade dynamics. By leveraging ‘Art of the Deal’ negotiation tactics, the US is implicitly setting the rules of engagement – and thus is able to break them when they see fit. This includes levying aggressively high tariffs, only to subsequently reduce or remove them as the US extracts more concessions. US Trade Representative Jamison Greer acknowledged as much to Bloomberg TV when he described waking on the August 1st deadline to a myriad of texts and emails from other countries eager to come back to the negotiation table: “I’m always going to talk to these folks and…if they have proposals…I’ll talk to them and brief the President.’

This ‘divide and conquer’ style of negotiation - along with the US’ position as the world’s largest consumer market - increases the odds that the US may be able to extract similar concession with regards to other major trade partners, such as China and Mexico. This lopsided power dynamic is one of the reasons RiverFront continues to favor US assets over international ones in our asset allocation portfolios.

US Stocks’ Resiliency Related to Bargaining Power, Strong Economy, and Earnings

What may be less well appreciated is that the outcomes will potentially also be more benign for the rest of the world than was initially feared back on April’s ‘Liberation Day.’ The baseline tariff of 10% the US set for countries not on the trade surplus list remain, a slight positive surprise from the 15% floor that the Trump Administration had threatened previously. Even Canada– which saw the baseline tariff on some goods rise to 35% from 25% on Friday – is likely to benefit from carve-outs related to the previously-signed United States-Mexico-Canada Agreement (USMCA) that takes the effective tariff rate on Canada closer to about 6%, according to Bloomberg.

While these seem to us like trade ‘wins’ for the US – and perhaps more benign than feared for the rest of the world - it is true to say that if implemented fully, the global tariff rate has increased markedly this year - to approximately 8.5%, according to a recent Goldman Sachs analysis. This represents the highest tariffs in decades and thus a potential drag on growth, as well as an inflationary impulse compared to what markets were contemplating back in January. However, with fewer countries willing or able to retaliate against the US in a coordinated fashion, the risks of the type of ‘tit for tat’ trade war that began to materialize during President Trump’s first term may be mitigated. This suggests that US and global economic growth may be less negatively impacted than originally feared. In addition, other factors support US stocks, including:

- Strong US Earnings Season, Especially for Tech: With about 60% of the S&P 500 having reported as of August 1st, over 80% of companies’ quarterly earnings results – and over 90% of tech - have thus far beaten consensus analyst expectations. Lost in the negative rhetoric on stocks last week was a series of generally strong earnings results for influential software and communications services companies, on the back of strong continued demand for artificial intelligence (AI) infrastructure.

- Economy Remains Solid: Last week’s strong 3.0% year-over-year annualized GDP growth suggests that the inventory-related distortions that weakened Q1 have been reversed. In addition, while manufacturing survey data has weakened recently, the S&P Global Flash US Services PMI registered over 55 for July, a seven-month high. This suggests to us that services – a much larger portion of the US economy than manufacturing – remains buoyant.

- Easier Fed on the Horizon? Friday’s poor jobs report suggests a labor market that is still expanding but slowing meaningfully. Labor data is closely watched by the Fed and, if this deterioration turns into a trend, it may be a catalyst for rate cuts if inflation trends stay moderate.

Conclusion: We Remain Constructive on US Stocks…Monitoring Risks Closely as We Move Towards Autumn

Despite last week’s volatility, we remain constructive on stocks with a preference for US technology and financials. From a risk management perspective, in our more conservative balanced portfolios we have been raising our equity reduction triggers as the market has made new recent highs. We are continuing to monitor the economic and earnings data mentioned above, as well as technical patterns. As we wrote about here, the technical primary trend for US stocks remains positive in our view. However, increased investor optimism does increase the potential for volatility in the near-term as the market moves closer to its’ Labor Day-to-Thanksgiving period…historically the most volatile part of the year.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.