Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

We wrote in last week’s Weekly View that ‘words matter now more than ever.’ This week we show that a picture is worth a thousand words. Below we show the four charts that we feel best explain RiverFront’s current portfolio positioning.

‘Unprecedented’ Drop In Business Sentiment Around The World

Bloomberg reported that almost three-fourths of companies used the word ‘unprecedented’ during their quarterly earnings calls to describe the economic fallout. Not surprisingly, business sentiment surveys, such as the Markit PMI, plunged in March. Major economies such as the UK, Germany, and France also saw record low sentiment (See chart right). Implication: RiverFront remains cautiously positioned in our balanced asset allocation portfolios, given the depth of the plunge in the global economy and low visibility going forward. We also remain underweight international equities, preferring US exposure.

Unprecedented Crisis Met By Unprecedented Stimulus

‘Unprecedented’ also describes the sheer magnitude of fiscal stimulus, with ‘helicopter money’ (direct cash payments to citizens) instituted not only in the US but even in fiscally-conservative countries such as Germany. This is in addition to widespread financial asset purchase programs in the US and elsewhere. While we think this will pull future growth forward, perpetuating the structural ‘low and slow’ growth drought we’ve written about before, we also believe this has created a backstop for risk assets in the near term.

A Health Crisis Needs A Health Solution, In Our Opinion

While stimulus from policy-makers is both needed and necessary to stem the market impact of such a sharp global slowdown, we believe it is not solely sufficient to create a new durable bull market for stocks. Rather, the world needs to gain confidence that the worst of COVID-19 is behind us, either due to a distinct ‘flattening of the curve’ (decreased new cases) and/or by discovery of treatment regimens that meaningfully improve the outcome of COVID-19 patients. While no medical treatment has definitively proven itself yet, we have witnessed an encouraging ‘flattening of the curve’ since the end of March in areas such as Spain, Italy, and more recently in the UK and the US (see chart right). We would caution that much is still unknown about the virus, with testing not yet widespread enough to say with certainty that a ‘second wave’ is unlikely. However, it does appear that extreme social distancing measures are working, giving mankind a game plan on limiting the spread of COVID-19 while awaiting broadly accepted medical treatments.

Implication: Proactive policymaker action and increased evidence of the West’s ability to ‘flatten the curve’ has helped provide a ‘floor’ for stocks. RiverFront has recently put some capital back to work in equities and is watching virus-related data closely from here.

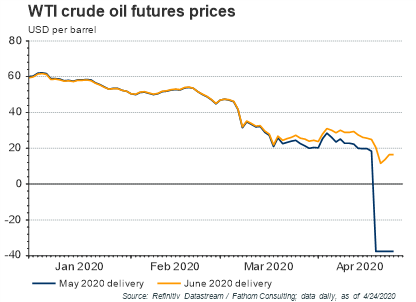

Unprecedented Moves In Oil Futures Market Points To Supply Glut

The unthinkable happened last week, with the May futures contracts for West Texas Intermediate (WTI- US oil) going negative (see chart). While there may have been several technical factors that exacerbated the down turn, we believe the main reason was a total lack of storage in the face of diminished demand. For the first time in history, near-term oil supply in the US has overwhelmed demand, causing participants to pay intermediaries to take their oil.

Implication: Because we believe it will take 6-12 months before global economies recover to their pre-crisis levels, we anticipate energy demand running well-below supply for the foreseeable future. Therefore, RiverFront remains underweight energy stocks and underweight cyclically-oriented industries whose businesses are closely correlated the economy and energy prices.