Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

SUMMARY

- We believe the Fed it is on the investor’s side, as the bar is higher to raise rates than lower rates.

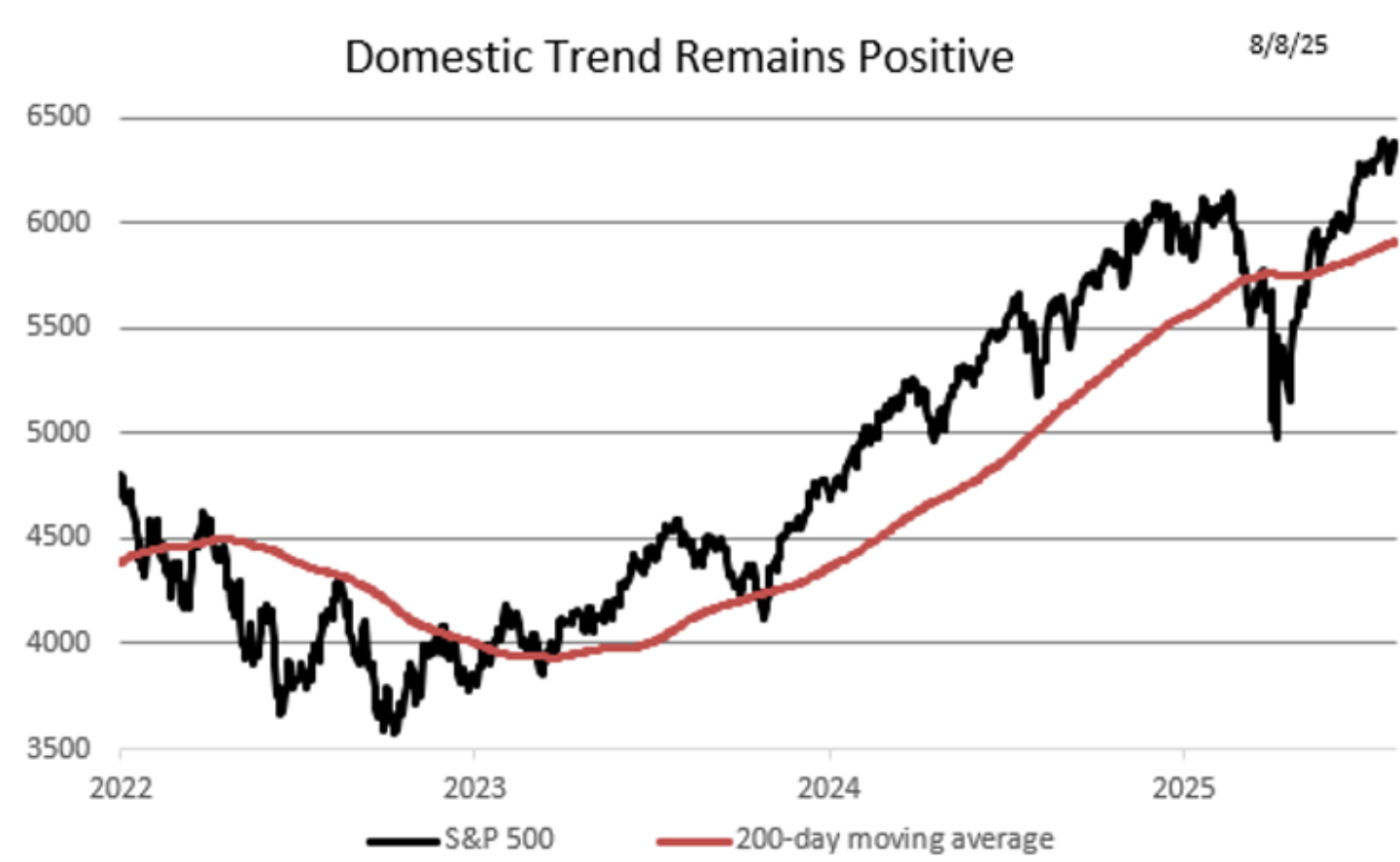

- The Trend remains positive, creating an opportunity for US stocks to grind higher.

- The Crowd’s neutral stance signals opportunistic buying of stocks, in our opinion.

Since the last update of our three ‘Tactical Rules’ on June 17th, both domestic and international equity markets have rallied, increasing roughly 6.9% and 3.7%, respectively. Since the 2025 market low on April 21st, domestic equities have outpaced their international counterparts by 10%, after underperforming them by 14% year-to-date prior to April 21st.

Despite the tails of two different trading regimes thus far this year, equity markets have prevailed and are up year-to-date. Equity markets have flourished due to strong second quarter corporate earnings in the face of tariff policy headwinds, pressure on the Fed to lower interest rates, and a labor market that is slowing. We think the reason for the positive performance of global equity markets can be explained by our three ‘Tactical Rules’ of “Don’t Fight the Fed”, “Don’t Fight the Trend” and “Beware of the Crowd at Extremes”. We believe the Fed remains on investors side with a bias towards cutting if the data permits, the trend is positive, and the crowd is neutral. While the Tactical Rules overall have not changed from a “flashing greenlight” since our last update, there have been some changes underneath the surface that we will explore.

‘Don’t Fight the Fed': Fed in a Quandary…but on Investors’ Side - FLASHING GREEN

After cutting interest rates by a total of one hundred basis points last year (basis point= 1/100th of a percent), the Fed has held interest rates steady through its first four meetings of 2025. However, unlike the previous meetings where there was unanimous agreement amongst the governors of the Federal Open Market Committee (FOMC), the June meeting saw two dissents. Governors Waller and Bowman both cited labor market deterioration for the reason for their dissent, with each wanting to lower the fed funds rate by 25 basis points. The governors were vindicated by a Non-Farm Payroll (NFP) report that showed the economy only created seventy-three thousand jobs in July, after less than stellar revisions for May and June that brought the 3-month average to thirty-five thousand.

To put this data into perspective, we look at the Fed policy through the lens of its ‘full employment’ mandate. In September 2024, when the Fed cut rates by 50 basis points, the 3-month average for NFP going into the September meeting was 82,000 jobs created. To achieve that same 3-month average as last year, the economy would need to create 159,000 jobs in August…this seems optimistic to us given the July data. Hence, if the data does not pick up, we could see the Fed cutting rates.

However, Chairman Powell has pointed out that his primary focus is on the unemployment rate, not the number of jobs created in each month. Right now, the unemployment rate is 4.2%, which would not ring the alarm bell at first glance. However, federal job cuts will begin to be counted towards the unemployment rate in October, so this number is likely to rise. It is possible that the federal job cuts could be offset by aging demographics and slowing immigration that could cause the participation rate to fall, but if it does not fall, the Fed may be forced to cut to stabilize the labor market.

The Fed will face a tough decision at its September 17th meeting as more governors may become concerned regarding the labor market, and others focus on the impact of tariffs and the accompanying inflation. The data will guide the Fed. We believe the bar is higher for the Fed to hike rates than for it to lower rates, so it remains on the investor’s side, in our opinion…we rate The Fed as a “flashing green light.”

Internationally, the Bank of England (BOE) cut its policy rate 25 basis points, to 4.0% at its August 7th meeting, after lowering rates by 25 basis points two meetings prior and then pausing. The BOE is expected to continue lowering its policy rate, based on the swaps market. Currently, the swaps market is forecasting the BOE to cut rates once more this year. Meanwhile, the European Central Bank (ECB) held its deposit rate steady at its last meeting in July as inflation came in at 2.3% year-over-year, which is above its 2% inflation target. While the speed of monetary policy easing is different at each of the major central banks, we believe the major central banks are fully aligned with “Don’t Fight the Fed” and are on the investor’s side. The Bank of Japan (BOJ) is the one exception, as it is currently raising interest rates after leaving them artificially low for an extended period.

‘Don’t Fight the Trend’: Positive Slope Leads to New Highs - GREEN LIGHT

The trend on the S&P 500, which we define as the 200-day moving average (SMA), has perked up as the technology sector has led the index to set a series of new all-time highs. In our last update the trend was within 1% of the then all-time high of 6144 and now it is within 50 points of the new high of 6389. The improved performance of the S&P 500 since our last update can be attributed to its improved technical view, as it unwound the “death cross”, where its 50-day moving average (MA) fell below its 200-day SMA and had a “golden cross” where the 50-day MA average rose above its 200-day SMA.

Currently, the trend is rising at a 13% annualized rate, and if history is any guide, this condition should bode well for stock returns over the next 3 to 6 months. This optimism is reflected across our balanced portfolios, as the portfolios are currently overweight US stock exposure. We believe that US ‘economic exceptionalism’ is not dead, as corporate America has adjusted well to the economic headwinds that have appeared this year, posting nearly 9% earnings growth year-over-year in the second quarter. Hence, domestically our rule of “Don’t Fight the Trend” is now signaling a “green light”.

International Trend: Slower but Still Strong - GREEN LIGHT

Internationally, the trend of the MSCI All Country World ex-US index (ACWX) has slowed over the last eight weeks but remains strong. The run rate of the primary trend is currently rising at a 12% annualized rate, compared to the 16% annualized rate on our previous update. We believe that the international trend slowdown was due to the headwinds that the US tariff negotiations created. However, we want to reiterate that the positive trend increases the probability of receiving above average returns over the next 3 to 6 months. Given that the trend remains strong, we are maintaining its “green light” rating that we initiated back in mid-March.

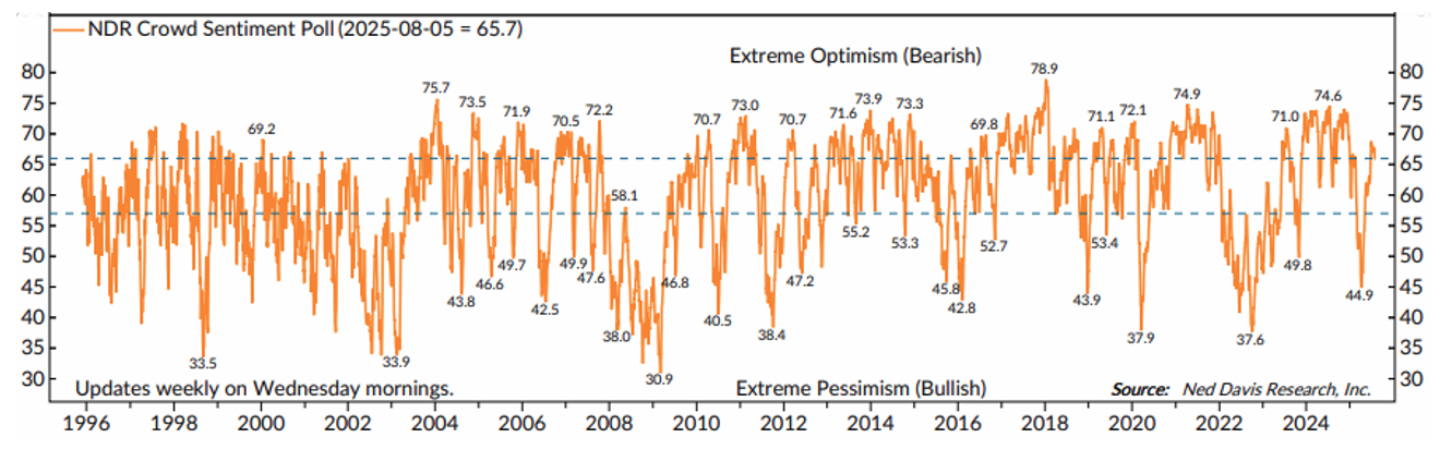

Beware of the Crowd at Extremes: Reacting to Recession and Stagflation Fears - YELLOW LIGHT

We regard Crowd Sentiment as the ‘contrary’ indicator of the three ‘Tactical Rules’. The chart below shows a measure of investor sentiment as calculated by Ned Davis Research (NDR). When the line is high it shows excessive optimism, and when it is low, extreme pessimism. NDR research suggests that historically, extreme pessimism can create attractive entry points for tactical investors. This is our preferred data source to measure investor psychology, though we use our own analytical framework from which to draw conclusions on sentiment.

Currently, the NDR Daily Sentiment and the NDR Weekly Sentiment Polls are both in the neutral zone. The Daily sentiment is sitting in the middle of the neutral zone, while the Weekly sentiment has been slower to retrace from the top of the neutral zone. In both cases, we tend to view the crowd’s recent reaction as a mild positive, as they remain a long way from reaching an optimistic extreme that would warrant consideration of a lowering of equity exposure. Historically, we have given more weight to the Weekly for this publication despite incorporating both measures of sentiment in our overall rating. The Daily tends to be a good indicator of the investor’s “real time” view of financial markets, while the Weekly gives a longer-term perspective of the Crowd. Given the current levels of the polls, we believe that the Crowd is well positioned for equity markets to grind higher. Similar to our last update, The Crowd is neither signaling an unequivocal buying nor selling opportunity for equities. Rather, it is giving a more nuanced, neutral signal suggesting opportunistic buying of equities, in our opinion. Hence, we are maintaining our rating for the Crowd of a “yellow light”.

Conclusion: The Tactical Rules Maintain the Bullish Signal… - FLASHING GREEN

The ‘Tactical Rules’ signal a “a flashing green light” even as the Fed finds itself in the unenviable situation of having its dual mandates complicate the decision of whether to cut or hold interest rates steady. The good news is that the Fed’s next move will not be to raise rates, in our opinion. Additionally, the trend remains strong, and the crowd has the appropriate temperament to react to whatever events present themselves in the coming months. The flashing green light signals that the economy is more resilient than market participants thought 8 weeks ago, in our opinion. Corporations have proven their ability to adjust to tariff headwinds on the fly for the second quarter in a row, after producing solid Q2 earnings. Hence, our Tactical Rules are giving us an overall bullish signal. Over the next 3 to 6 months, we believe that market conditions favor both domestic and international equities as both have central banks and strong trends on their side.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.