Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

Each quarter we publish a chart pack meant to keep investors apprised of each of the major inputs to our portfolio management process: strategic asset allocation; global macro and tactical outlook; and security selection and risk management. In this edition of the Weekly View we have chosen to focus on security selection and risk management given their elevated importance to portfolio returns during mature bull markets. For the complete Q3 2019 Chart Pack, click here (link for financial advisors only.)

Security Selection Important As Bull Market Matures

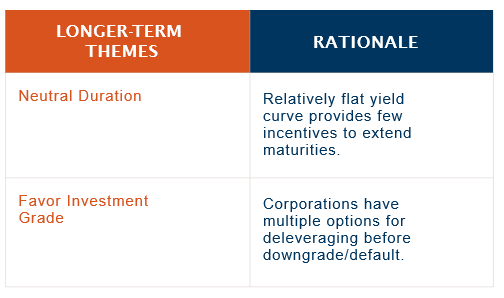

Fixed Income: In a low-interest rate environment, we believe the asset class that appears least attractive / most overvalued is fixed income; with 10-year Treasury yields well-below 2%.

Therefore we think security selection in the bond market is even more important than security selection in the stock market. For example, in the US many bonds fail to offer positive yields after accounting for normal levels of inflation. Overseas, the prospects are even dimmer with sovereign bonds offering negative yields throughout the developed world.

Because we expect that inflation will remain below the Fed’s target of 2% and 10-year Treasury yields will remain between 1.5% and 2.0%, we don’t expect a bear market in bonds. Therefore, our fixed income positioning is structured to dampen volatility, especially in our shorter-time horizon portfolios.

International Equities: While we believe international equities as an asset class are more attractively valued than US equities, the heightened geo-political uncertainty warrants the need for greater selectivity in foreign stocks. There are two issues we have tried to mitigate. First, with the trade war still simmering, we see earnings under pressure in export-oriented economies, especially emerging markets. Second, we expect earnings to be further pressured in parts of Europe, particularly the UK, as companies forego hiring and spending until Brexit is resolved.

Unlike the US, whose economy has remained relatively stable thanks to the US consumer, overseas consumer and business sentiment surveys remain poor. As can be seen in the table on page 1, we have sought to limit our exposure to those regions most impacted by trade and European politics.

US Equity: ‘A rising tide lifts all boats’ seems to have been the theme for US equity markets since the Great Recession ended in 2009. However, after a decade of strong equity returns, the likelihood of above-average returns has decreased, in our view. We therefore expect security selection to play a growing role in portfolio performance, similar to the latter stages of previous bull markets. Our current security selection favors themes and companies that share the following characteristics:

- Ability to grow revenue in a slow economic environment.

- Possess efficient and prudent capital structures to weather economic hiccups.

- A history of rewarding shareholders with growing dividends.

The right table highlights a few of our current preferences in US equities.

Risk Management: Heightened Uncertainties Demand Risk Management Plans

RiverFront’s Risk Management is designed to keep emotions out of the investment decision making process. The risk management process is layered and focused on identifying the risks associated with individual positions as well as broader portfolio risks such as: asset class, country, and sector exposures. Its four key tenets are:

- Independence of risk team

- Identify and quantify risk

- Set boundaries and monitor

- Authority to take action

Geo-political risks are currently high and many of these risks have binary outcomes... ‘good’ or ‘bad’… and it is critical to plan for either result. We have described our approach to this environment as: ‘stay at the party but drink water.’ ‘Staying at the party’ is all about participating in the upside from a ‘good’ outcome by maintaining exposure to global stock markets. ‘Drinking water,’ on the other hand, is remaining sober to the risks. With our portfolios positioned in-line with long-term equity/bond targets, we have the flexibility to quickly adjust our portfolio mix and have plans in place to do so.