Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

SUMMARY

- While the President believes the Fed should be fiscal policy dependent, the Fed has resisted political influence.

- The bond market views Fed independence as crucial for policy credibility.

- RiverFront believes political pressure applied to the Fed will cause rates to remain higher for longer.

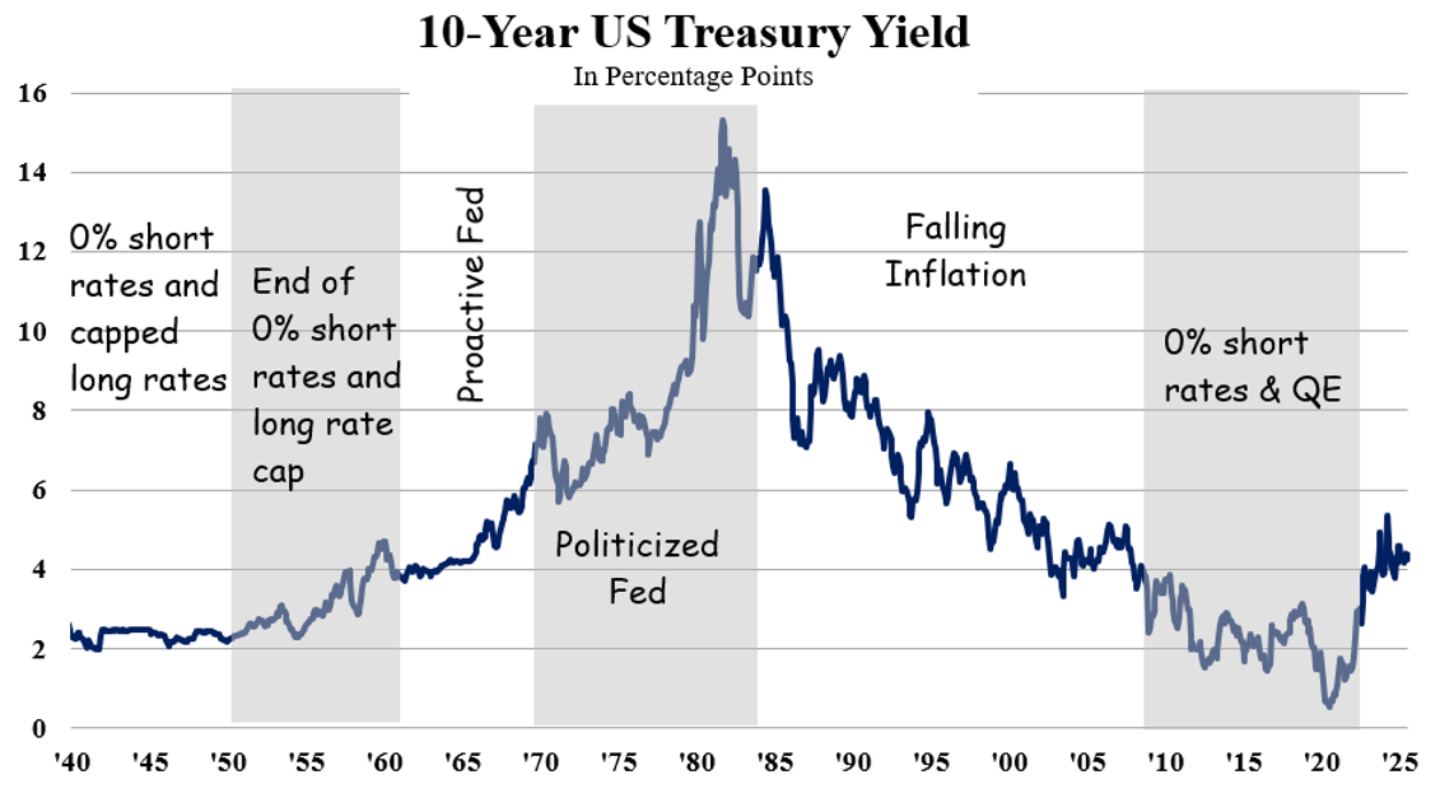

Much ink has been spilled over the years regarding the importance to markets of the Federal Reserve (Fed) maintaining its ‘independence’ from political pressure. Throughout the century-plus history of the Fed, we find times that it has acted both independently and otherwise. Recently, this issue has commanded attention due to President Trump voicing his displeasure with the level of interest rates, trying to nudge the Fed to lower rates.

While President Trump might not be the first President to try to influence the actions of the Fed, he is the first since Richard Nixon cajoled Fed Chair Arthur Burns to lower rates in the 1970s. Nixon wanted to boost government spending and cut interest rates simultaneously despite rapidly rising oil prices. The result of the Nixon and Burns experiment was runaway inflation that subsequent Chair Paul Volker ultimately reined in. Since the Volker era, the Fed has sought to delineate a clear division between monetary policy and politics. This is important to the Fed, because without it, monetary policy decisions will not carry the same degree of creditability.

We do not believe that today’s pressure will result in runaway inflation, nor will it be effective in influencing the Fed. We reached this conclusion by analyzing various perspectives of the President, the Fed, and bond market investors, as detailed below. This analysis has helped solidify our belief that the Fed will retain its’ independence, and political pressure will cause rates to come down slower, not faster. Given this dynamic, as well as our sanguine view on the economy, we remain underweight fixed income.

President Trump’s View: Fed Should be Fiscal Policy Dependent

The Trump Administration just passed the “One Big Beautiful Bill” which made the 2017 tax cuts permanent, instead of expiring at the end of 2025. It has often been said, “nothing in life is free.” This rings true with the “One Big Beautiful Bill” as it is projected to increase the budget deficit over the next 10 years by $3.4 trillion, according to the Congressional Budget Office. Hence, the US Treasury will have to finance the deficit by issuing debt, as the administration’s tariff policy will only cover a small portion. However, at current levels the task is almost untenable with the effective fed funds rate at 4.33%, as the interest on the projected $3.4 trillion increase would amount to roughly $147.2 billion annually.

President Trump wants to ease the government’s financial burden by having the Fed lower rates, preferably to as low as one percent. This approach is like the financial repression era after WWII that is highlighted in the chart below. In 1942, the Fed entered an agreement with the US Treasury to keep short-term interest rates at three-eighths of a percent until 1951. Additionally, 10-year Treasury yields were capped at 2.50%. The agreement between the Fed and US Treasury allowed the US to inflate its way out of debt by keeping real yields artificially low, thus lowering the overall percentage of debt relative to GDP. While the Trump administration has not explicitly stated that financial repression is part of its playbook, we believe the President is attempting to revive fiscal and monetary policies of the 1940s to tackle the government over spending.

The Fed View: Monetary Policy Independent but Data Dependent

The Fed has a dual mandate of full employment and price stability. So, let us walk through the Fed’s view. Currently, the unemployment rate sits at 4.10% which is well below the Fed’s forecast of 4.50%. While the federal government layoffs/buyouts will not figure into the unemployment rate until October, they will only add a couple of tenths of a percentage point, leaving the labor market below the Fed’s year-end forecast. From this vantage point, the Fed feels that the labor market is in decent shape, despite a few fissures that appeared in the June non-farm payroll report, in our opinion. These fissures include slower private payrolls, state and local government hiring dominance, and lower immigration shrinking the workforce.

To analyze the Fed’s objective of price stability, we now pivot to Core PCE (Personal Consumption Expenditures, ex-food, and energy). The Cleveland Inflation ‘Nowcast’ is currently forecasting 0.22% month-over-month changes for June and July. If the Nowcast forecast is accurate, and we hold the monthly changes at that level for the remainder of the year, Core PCE will end the year at 2.8%. However, if we use the latest actual data, May’s 0.18% month-over-month change, for the remainder of the year, Core PCE will end the year around 2.5%. In neither case will the Fed hit its 2% target by year-end. However, under one scenario progress is being made and under the other there is none. We believe this level of uncertainty in the inflation forecast is exactly why the Fed has been reluctant to lower interest rates without knowing the full impact of tariffs. Unfortunately for the Trump administration, with tariff negotiations dragging on beyond the previously set July 9th deadline, the Fed’s window for cutting rates will extend as it awaits clarity from the data, in our opinion.

Bond Market View: Fed Independence Equals Creditability

Investors view the Fed as an independent entity, and when the Fed’s status is perceived differently bond buyers tend to push yields higher. Bond buyers place a premium on the Fed acting independently from the government, thus ensuring that monetary decisions are made solely for the purpose of price stability. As mentioned previously, the market wants an unbiased arbiter of monetary policy given the interconnectivity of currencies and interest rates globally due to the US having the reserve currency of the world. A Fed that loses its independence is a central bank that loses its creditability in the eyes of investors.

This was recently highlighted by speculation around the President possibly firing Chairman Powell, causing yields to rise before the rumor was debunked by Trump himself. While the ability of the President to remove a Fed Chairman is questionable given a May 2025 ruling suggesting the Supreme Court would act to protect the Fed as a quasi-private entity, speculation around this risk is likely to keep bond yields elevated. Given these pressures, we remain underweight interest rate sensitivity relative to our benchmarks in our balanced asset allocation portfolios.

RiverFront’s View: Ironically, Political Pressure Likely to Keep Rates Higher for Longer…at Least Until the Next Chair

President Trump’s public criticism of Chairman Powell will backfire, in our opinion. Regardless of the FOMC members’ political affiliation, we believe members respect the sanctity of the central bank’s independence, and the creditability that it affords their decision-making process. For this reason, if the Trump Administration nominates a chair-in-waiting to try to sway the thinking of members, there is no guarantee that their votes will align with the President’s wishes.

Furthermore, we believe the more the President voices his displeasure on rates, the slower the Fed will move because it wants to avoid the appearance of politics in its rate decisions. Hence, if the President just lets the data guide the committee, ironically, we think rates could fall sooner. Throughout 2025, we have been saying that the Fed would be ‘slower to lower’, going as far as stating that it would not cut rates at all this year. However, if Core PCE trends closer towards 2.5% instead of its current 2.8% trajectory after tariff negotiations are concluded, we believe that the Fed will cut once before year-end.

It is possible that all this noise is more of a signal sent by the Administration that, rather than act on Powell in ’25, the next Chair (nominations could happen as early as September) is likely to be more dovish. A more dovish Fed would likely help stocks, but if the move were seen as political rather than data driven, longer maturity bond yields could well stay elevated, in our opinion.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.