Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

Today’s Weekly View represents a summary companion to our recently released 2020 Outlook. Investors may be dizzy when staring at a stock chart these days, with US stocks at all-time highs. Call it ‘altitude sickness’ – that disorienting combination of risk aversion and loss aversion that can result in investors missing out on markets that are going up. We think succumbing to this altitude sickness is a mistake for investors in 2020. RiverFront believes the most likely scenario for 2020 is for markets to continue to climb a ‘wall of worry’ to new heights, albeit in an uneven fashion.

Our base case predicts that an easing of trade tensions and expansion of central bank liquidity will lead to a mildly positive global corporate earnings cycle in 2020. We would view the signing of USMCA, a ‘phase-one’ China trade deal, and France’s agreement to extend negotiations on the proposed ‘digital tax’ as promising signs of easing trade tension. We believe that both history and momentum are on investors’ side this year; presidential election years tend to be positive, and global stock breadth is improving. Despite this attractive backdrop, fund flows into equities have been dwarfed by flows into bonds, suggesting a lack of the type of euphoria usually present at structural market peaks.

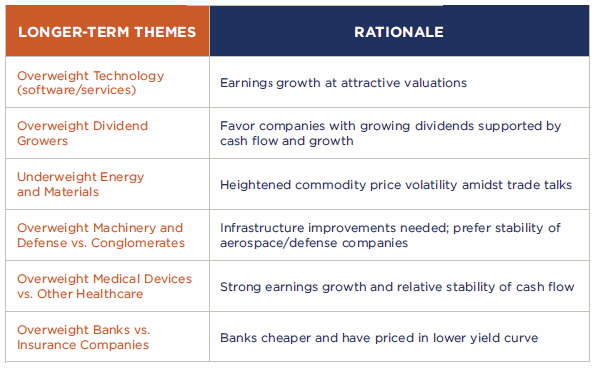

In keeping with these views, we favor equities over bonds in our balanced portfolios. Our preferred investment themes include Technology, Healthcare, consumer-oriented logistics, defense contractors, and companies who consistently grow cash flow and pay dividends. We also start the year constructive on Japanese equities and other selected European and Asian markets. While international stocks in general remain a ‘show-me’ story given their compromised economic backdrops, they may have the most potential upside in a bullish global economic scenario in 2020.

RiverFront Portfolio Themes

Riverfront’s Base, Bear, And Bull Case Scenarios For 2020

A yearly tradition for us is to publish a base, bull, and bear case in our Outlook, along with RiverFront’s opinions of the relatively probabilities of each. This year, we assigned a combined 85% probability of positive total returns in global markets in 2020, with the magnitude of these gains highly dependent on a continued trade truce, the restart of a stagnant corporate earnings cycle, and the outcome of the 2020 elections.

While stock valuations rose meaningfully in 2019, we must contend with the possibility that ultra-low bond yields are with us for the foreseeable future, driving up the scarcity value of the yields provided by stocks. A comparison of stock dividend yields to “risk-free” rates across the globe suggests stocks are still highly attractive relative to bonds and cash. In our base case scenario, corporate earnings show single-digit growth this year, a function of bottoming global economies and a ‘low-bar’ from last year’s flat to down earnings performance. We acknowledge that a higher starting point creates greater risks for future returns and sets up 2020 to be a potentially volatile year. Potential volatility may be compounded by the reality that the US will face an even more contentious than usual presidential election in November.

We view a true bear case scenario as relatively unlikely because we believe it would require a series of events, each of which is somewhat possible in isolation but much less likely to occur in tandem. These include a trade war reacceleration leading to a 2nd half recession in the US, a Democratic sweep of both the presidency and Congress in November, combined with little action from the Federal Reserve should the first two events occur. On the flip side, the bull case would require the type of environment that we witnessed in 2017, with global economic growth and earnings both surprising meaningfully to the upside on the back of calmer geopolitics in Asia and Europe. While this not our most likely scenario, we view it as incrementally more probable than the bear case.

Riverfront’s Base, Bear, and Bull Case Scenarios for 2020

2020 Outlook Positioning Highlights:

- RiverFront favors stocks relative to bonds in our balanced asset allocation portfolios. We place a relatively high probability of positive returns for equities in 2020, though we acknowledge that the strong end to 2019 may lead to higher volatility in the year to come.

- Our base case scenario predicts that an easing of trade tensions and expansion of central bank liquidity will lead to a mildly positive global corporate earnings cycle in 2020.

- We think both history and momentum are on investors’ side in 2020; Presidential election years tend to be positive, and global stock breadth is improving.

- We remain constructive on US stocks, believing stock valuations can stay elevated with the lack of attractive yield in the bond market. We see opportunity in certain industries within Technology, Healthcare, consumer-oriented logistics, defense contractors, and companies who consistently grow cash flow and pay dividends.

- International stocks are still a ‘show-me’ story given their compromised economic backdrops; however, areas like Japan and certain parts of Europe and emerging markets may have the most potential upside in a bullish global economic scenario in 2020.

- Regarding bonds: it’s hard to get too excited given the starting point for both yields and spread.