Your choice regarding cookies: We use cookies when you use this Website. These may be 'session' cookies, meaning they delete themselves when you leave the Website, or 'persistent' cookies which do not delete themselves and help us recognize you when you return so we can provide a tailored service. However, you can block our usage by adjusting your browser settings to refuse cookies.

Sweat the Small Stuff

SUMMARY:

- The often overlooked ‘small stuff’ can make a significant difference to portfolio returns, in our view.

- The small stuff includes maximizing time in the markets, regular rebalancing, minimizing concentrated positions, diversification, and managing taxes.

- We believe RiverFront’s balanced Advantage portfolios are designed to sweat the small stuff, as well as the big stuff.

With apologies to Richard Carlson, the author of the 1997 self-help sensation 'Don't Sweat the Small Stuff'… Investing is one of those fields where the 'small stuff' can really matter.

While the 'big stuff' such as asset allocation, security selection, and risk management are important components of portfolio returns, the often overlooked ‘small stuff’ also matters and deserves attention. One of the great things about the small stuff is that it often does not require a prescient forecasting ability to be additive to portfolio returns. In our view, investors should 'sweat the small stuff' or partner with someone who does.

We believe that the ‘small stuff’ includes:

Maximizing time in the market:

“Someone’s sitting in the shade today because someone planted a tree a long time ago” – Warren Buffet

In today’s low interest rate environment, large cash holdings could be an obstacle to funding future obligations, such as college or retirement. There is also a chance that long-term inflation rates rise with increased quantitative easing (QE) and generous fiscal stimulus programs, ultimately eroding purchasing power. When cash is accumulating a reasonable level of interest in the bank or in a brokerage account, the long-term costs of sitting out can be less punitive. However, with short-term rates below inflation, cash on the sidelines provides negative real returns as it sits idle. Therefore, if one needs their portfolio to grow, less risk-taking today could lead to greater risk taking tomorrow.

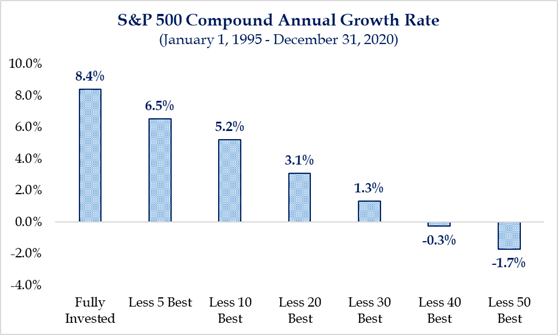

Additionally, in our view, the longer an investor’s time horizon, the less important market entry points are. In fact, as can be seen in the chart below, missing just a few of the stock market’s best days can be significantly impactful to investment returns and missing the best 40 - 50 days translates to negative returns. Therefore, we believe that long-term investors should focus on ‘time-in’ the markets instead of ‘timing’ the market and we structure our portfolios to reflect this reality.

Controlling concentrated positions:

In our opinion, concentrated positions present one of the biggest obstacles to achieving investors’ long-term goals.

A concentrated position can be like a tall tree in a lightning storm. We believe that the more a single position stands out from the rest of the portfolio, the greater the chance of a devastating lightning strike. It is for this reason that institutional investors, such as pension funds and endowments, put limits on the maximum size of an individual position in their portfolio. We also think a concentrated position in the stock of an employer is especially dangerous. Typically, the performance of a company’s stock price is strongly correlated to the job security of that company’s employees. During periods when job security is low and compensation most under pressure, an investor with a portfolio dominated by the stock of their employer will likely find their financial hardships exacerbated.

Another issue to consider is that company lifespans have significantly shortened. According to a McKinsey study published in February 2018, the average company listed on the S&P 500 in 2010 had a lifespan of about 14 years, which represents a significant decline from the 90-year lifespan companies enjoyed in 1935. While the cause of shortening corporate lifespans can be disputed (technology disruption, acquisition, etc.); the conclusion that companies die more quickly today is what is important.

Our advice is to recognize the risks that concentrated positions represent and to assemble a plan that includes three key components: starting now, identifying an end target allocation for a particular holding (for example: less than 10% of the portfolio); and pre-determining divestiture dates that will reduce this risk over time.

For more on concentrated positions, we dedicated our April 6th, 2020 Weekly View to this subject.

Diversification:

There is a saying that the moment that a second investment is added to a portfolio is the moment that an investor is destined to own something that will underperform. For this reason, it can be alluring to chase only the investments that are outperforming and avoid those that are underperforming. The problem with this strategy is that the market’s ‘winners’ and ‘losers’ constantly change. Diversification is a process that recognizes that it is impossible to consistently forecast future market favorites and thus allocates portions of the portfolio across multiple investments. Diversification is multi-dimensional and can be applied to asset classes (US large-cap, International, etc.), selection within an asset class (stocks and bonds); investment styles (value, growth, etc.), and methodologies (active and passive). Methodology diversification is an often overlooked but is becoming increasingly important, in our view. This is because some of the major stock market indices may not be the diversifiers they once were. For example, over 22% of the S&P 500 is allocated to just 5 companies. Additionally, technology and communication services now account for nearly 39% of the index.

Regular rebalancing:

A process for systematic rebalancing back to an agreed portfolio mix is a way to 'buy low and sell high.' For example: following an especially good time for stock returns relative to bond returns, a portfolio will see its stock weighting increase. In this incidence, periodic rebalancing involves selling stocks after strong performance. Equally, when stocks decline enough to alter the desired mix, bonds can be sold to add to stocks and bring them up to the desired balance. This is not a timing decision, but one where the parameters for rebalancing are agreed during the planning process.

Minimizing taxes:

Finally, taxes can be another often overlooked contributor to returns. Taxes can add up and large portions of investment gains can be lost to taxes without proper planning. Between federal taxes on short-term capital gains and state and local taxes, as much as half an investors’ return can be lost in taxes. Investors will not only feel the sting in the short-run, but that sting will be magnified multi-fold in the long-run after considering that ‘taxes paid’ lose the ability to compound into the future.

Navigating today's increasingly complex and fluid tax environment requires careful planning. For example, a smart investment plan should maximize the benefit of the more favorable long-term capital gain tax rate. For 2020, the maximum capital gains rate is 20%, well below the top ordinary income tax bracket of 37%. There is a threat that the current tax environment could become significantly less favorable. With recent fiscal stimulus packages to combat COVID-19, the Federal budget deficit has continued to expand. Eventually, we and many policy experts believe that the Federal government will need to find creative ways to generate additional tax revenue down the road. In other words, the current maximum long-term capital gains tax rate may be a gift with an expiration date. Thus, the taxes saved by deferring a capital gain today could be negated by significantly higher tax rates tomorrow.

RiverFront ‘sweats the small-stuff’ in at least four ways:

- Maximize time invested: RiverFront’s asset allocation process and our risk-management discipline are designed to maximize the time each portfolio is invested, as appropriate for an investor’s time horizon.

- Rebalance and concentrated positions: The portfolios are regularly rebalanced by our portfolio management team and concentrated positions in a single stock are not allowed.

- Diversification: RiverFront’s Advantage portfolios are constructed to be diversified across at least 4 dimensions: asset class, selection, style, and methodology.

- Tax-Managed: While RiverFront’s portfolios are not specifically managed for taxes, investors may enjoy some of the benefits of tax management by utilizing tax-planning customization tools and by working with a Financial Advisor.